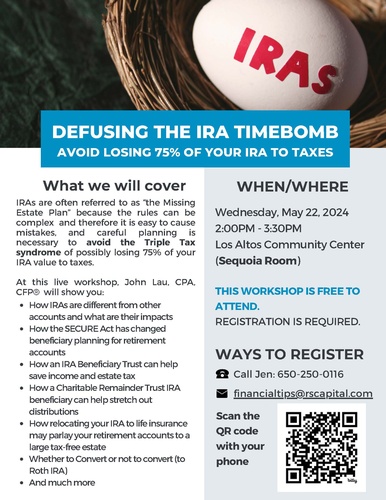

Defusing the IRA Timebomb: Avoid Losing 75% of Your IRA to Taxes

Retirement accounts make up a large part of many people’s estates; unfortunately, many IRA owners and their advisors are not familiar with the complicated tax laws regarding distributions from retirement accounts.

Why is this? Because retirement accounts are different!

Therefore, you must separate the retirement accounts from the rest of your estate and establish a proper plan for distribution of these assets. Although many individuals have established complex planning strategies, many have not addressed the planning issues of IRA and other retirement plans. IRAs are often referred to as “the Missing Estate Plan” because the rules can be complex and therefore it is easy to cause mistakes, and careful planning is necessary to avoid the Triple Tax syndrome of possibly losing 75% of your IRA value to taxes.

At this live workshop, John Lau will show you:

- How IRAs are different from other accounts and what are their impacts

- How the SECURE Act has changed beneficiary planning for retirement accounts

- How inheriting an IRA account does not automatically stretch out the 10-year distribution unless your beneficiary does one more thing…

- How an IRA Beneficiary Trust can help save income and estate tax

- How a Charitable Remainder Trust IRA beneficiary can help stretch out distributions

- How relocating your IRA to life insurance may parlay your retirement accounts to a large tax-free estate

- Whether to Convert or not to convert (to Roth IRA)

- And more

Presented in collaboration with the Los Altos Community Center.

Date and Time

Wednesday May 22, 2024

2:00 PM - 3:30 PM PDT

May 22, 2024 | 2:00PM - 3:30PM

Location

Los Altos Community Center

97 Hillview Ave, Los Altos, CA 94022

Fees/Admission

This event is Free

Website

Printed courtesy of chambermv.org/ – Contact the Mountain View Chamber of Commerce for more information.

580 Castro Street, Mountain View, CA 94041 – (650) 968-8378 – info@chambermv.org